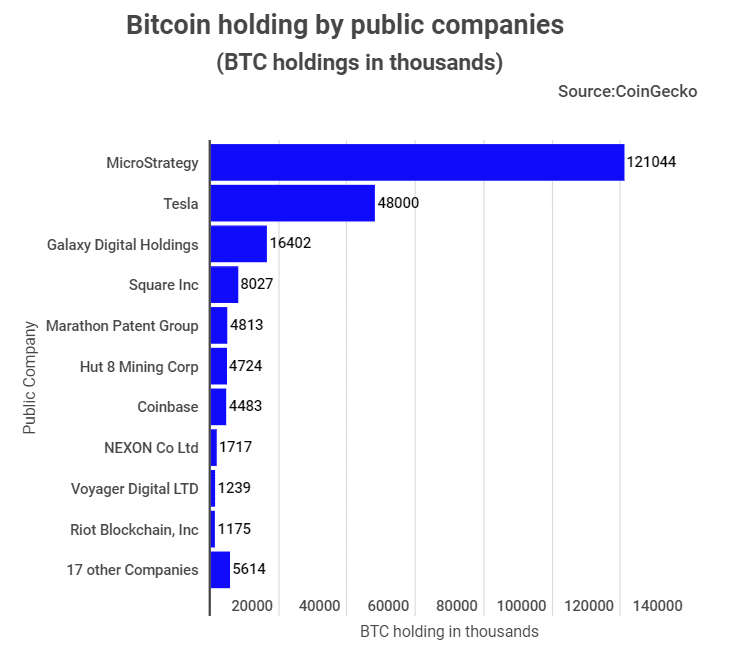

London, Business News: tradingplatforms.com, the BTC dominance of public companies stands at 1.15 percent. The data shows that 27 public companies hold over 217 thousand Bitcoins (BTC) in their treasuries.

The metric considered BTC’s circulating supply of roughly 18.94 million coins at press time. Additionally, public companies’ BTC investment value topped the $8B mark.

Tradingplatforms.com’s Edith Reads has been talking up the figures. She opines, ” The corporate foray into BTC is a positive thing. For starters it emboldens would-be investors that despite its volatility, BTC remains a viable investment alternative. Secondly, it helps in mainstreaming the asset making it readily available for many.”

Leading the pack

MicroStrategy, the premier online analytics firm led the pack in BTC held. The firm holds 121, 044 BTC, which, from an outlay of nearly $3.6 billion, has grown to over $4.5 billion in value.

Tesla placed second on the list with a BTC ownership of 48,000. From an initial investment of $1.5B, this reserve’s value has grown to about $1.75B currently.

In the third spot was Galaxy Digital Holdings. The firm owns 16,402 BTC valued at over $614 million. Square Inc, Marathon Patent Group, and Hut 8 Mining Corp are other notable inclusions in the top ten.

Public Companies are embracing BTC

The onset of the COVID-19 pandemic saw a shift in perceptions about cryptos. The general positive sentiments regarding digital currencies have been a boon for bitcoin.

This shift is most evident in the corporate scene. While initially dismissive of this asset class, many institutions have changed their outlook on them. Today corporate investors hold over 1.6 million BTC, amounting to nearly 8% of the king crypto’s 21M hard cap.

One factor favoring their BTC acquisition is inflation. The global economy is still recovering from the impact of the Corona crisis. During that period, BTC emerged as an effective hedge against inflationary tendencies.

Additionally, public companies are looking to diversify their portfolios. Thus cryptos offer them new investment options.