2022 business year provides solid basis for the future

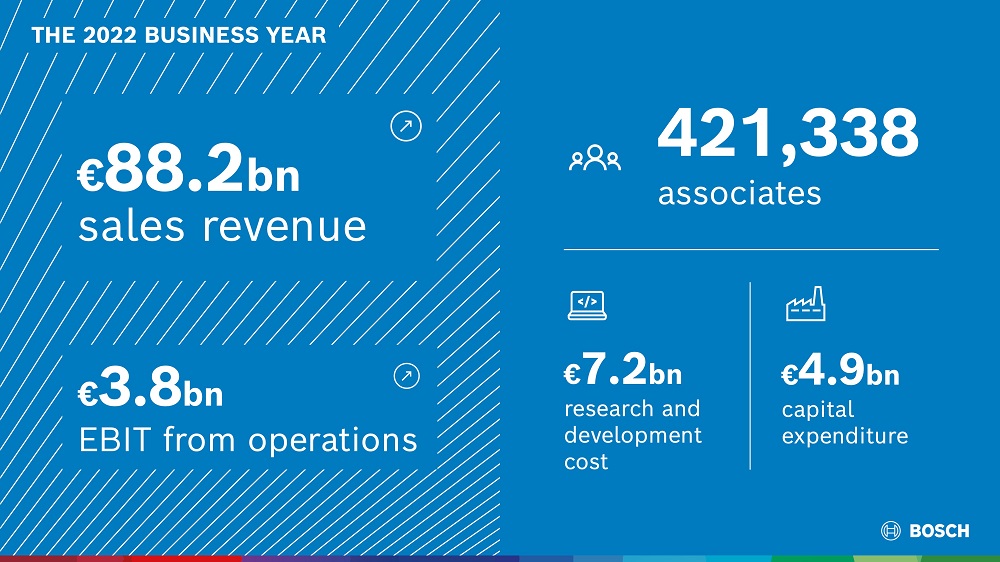

„ Targets for 2022 business year achieved: sales of 88.2 billion euros / earnings of 3.8 billion euros / EBIT margin from operations of 4.3 percent.

„ Outlook for 2023: global economic growth of 1.7 percent / sales to grow 6 to 9 percent / EBIT margin from operations in the region of 5 percent

„ Heavy investments in securing the future: more than 12 billion euros R&D and capital expenditure in 2022

„ Realignment of mobility business: business sector aiming for sales of more than 80 billion euros by 2029.

„ Stefan Hartung: “With technology ‘Invented for life,’ our aim is to grow in every region of the world and to be among the leading three suppliers in our relevant markets.”

„ Markus Forschner: “In 2023, we want to come one step closer to our long-term target of at least 7 percent margin.”

Dubai, UAE, May 08, 2023: In 2022, Bosch exceeded its business targets in what was a challenging year. The supplier of technology and services increased its total sales to 88.2 billion euros, following 78.7 billion euros the previous year. This is an increase of 12.0 percent, or an exchange rate-adjusted 9.4 percent. At 3.8 billion euros, EBIT (earnings before interest and taxes) from operations is also higher than the previous-year figure of 3.2 billion euros. The EBIT margin from operations rose from 4.0 to 4.3 percent. Presenting the company’s annual figures, Dr. Stefan Hartung, the chairman of the board of management of Robert Bosch GmbH, said: “We rose well to the challenges of 2022 – both our sales and our margin were higher than expected. And even if the economic and social environment remains demanding, we want to grow significantly faster.”

In the years ahead, given normal rates of inflation, the aim is for annual sales to grow by 6 to 8 percent on average, and for margin to reach at least 7 percent. “Our aim is to grow in every region of the world and to be among the leading three suppliers in our relevant markets,” Hartung said.

The fight against climate change is causing considerable upheaval in business and society, and also accelerating technological change. “This technological transformation is opening up growth opportunities that we want to seize, both in our existing business and in related and new areas,” Hartung said. “In this context, our ‘Invented for life’ ethos is ideal – not only when it comes to the major trends of electrification, automation, and digitalization, but more than ever also with respect to software and artificial intelligence.”

Investments in the future: innovative strength needs financial strength

“Despite the challenging environment, we can look back on solid results in 2022. On top of that, we have prepared the ground for Bosch’s success in the markets of the future,” said Dr. Markus Forschner, the CFO of Robert Bosch GmbH. All in all, the company spent more than 12 billion euros last year on securing its future. Expenditure on research and development rose to 7.2 billion euros (from 6.1 billion euros in 2021), or 8.2 percent of sales (7.8 percent in 2021). Capital expenditure also increased by 1 billion euros to 4.9 billion euros. The equity ratio rose slightly to 46.6 percent (2021: 45.3 percent). Apart from upfront investments, ensuring outstanding ability to deliver in times of great uncertainty tied up funds. This resulted in a negative free cash flow of 4.0 billion euros last year. As Forschner pointed out: “Even if Bosch does have the necessary funds and a very sound financial position, we have to maintain a difficult balancing act between investments and cost discipline.”

Outlook for 2023: cost pressure, inflation, and a cooling economy

Despite the after-effects of the Covid-19 pandemic, the Bosch Group was able to increase its sales by 3.5 percent in the first quarter of 2023. North America developed especially favorably, with double-digit growth of 18.0 percent. In Europe as well, the company grew by a strong 7.7 percent. “The first few months of the new business year have shown that 2023 will also be a challenging year,” the CFO said. He explained that he expects prices on the raw materials and energy markets, as well as inflation, to remain high. For 2023, Bosch expects global economic output to grow just 1.7 percent, and thus to cool by a further considerable degree year on year. Despite the modest economic outlook, Bosch is aiming for sales growth of between 6 and 9 percent in 2023. Its target for EBIT margin from operations is in the region of 5 percent. “In this way, we want to come one step closer to our long-term target of at least 7 percent margin,” Forschner said. “We have set ourselves an ambitious roadmap.”

Mobility business: growth through realignment

Bosch is realigning its mobility business to changed market and customer requirements. The aim is to be able to serve existing and new customer needs even better and faster with customized solutions from a single source. “We want to remain a leading supplier of technology and the preferred partner for our customers in the mobility industry. We’re preparing the ground for this,” Hartung said. What has up to now been the Mobility Solutions business sector, with some 230,000 associates at more than 300 locations in 66 countries worldwide, will now be known as the “Bosch Mobility” business sector. Within the company, it will be responsible for its own business and have its own leadership team. Effective January 1, 2024, the individual divisions will be redrawn in some cases and given horizontal responsibilities as well. The Bosch chairman announced that the aim is for the newly restructured mobility business to grow annually by an average of roughly 6 percent up to 2029, when it will achieve annual sales of more than 80 billion euros. One pillar of its future growth will be the market for automotive software, which is expected to triple by the end of the decade. In this market, Bosch Mobility will provide its customers with software solutions for operating systems and domain-specific applications for software-defined vehicles. Bosch is also significantly expanding its automotive electronics business: to serve the growing demand for silicon-carbide chips, the company plans to take over parts of the business of the U.S. chipmaker TSI Semiconductors. Over the next few years, Bosch wants to invest more than 1.4 billion euros in the U.S. company’s Roseville location in California, and to retool its manufacturing facilities. Starting in 2026, the first chips are to be produced there on 200-millimeter wafers based on the innovative material silicon carbide (SiC).

Energy and Building Technology: growth with the move to alternative heating

Hartung believes that the overhaul of global energy systems in particular is a source of additional business potential: “Growth won’t just be found on our roads, even if we are very successful there,” Hartung said. “When it comes to the electrification of heating systems, our heat pumps are very much in demand.” At Bosch, this field is just as much a driver of above-average growth as electrical powertrains for vehicles. The company is expanding its heat-pump capacity and wants to invest more than 1 billion euros in total in Europe by the end of the decade. Following the start of volume production in Eibelshausen, Germany, at the start of the year, Bosch recently announced the construction of a further plant in Dobromierz, Poland. To make it affordable for homeowners to modernize their heating systems, Bosch is promoting hybrid solutions as well; the use of an existing gas-fired boiler in combination with a smaller-scale heat pump often rules out the need for extensive refurbishment. Compared with a heat pump-only solution, this can reduce modernization costs by as much as 30 percent. Bosch expects the European heat-pump market to grow 20 percent in 2023 – with sales related to this growing more than twice as fast at Bosch. This rapid growth is expected to last until the middle of the decade. Bosch is also benefiting from the move to make commercial buildings more energy- and cost-efficient. In acquiring Hörburger AG, the company recently extended its portfolio to include building automation.

Industrial technology and consumer goods: ambitious growth targets

In its industrial technology and consumer goods businesses as well, Bosch is on a growth path. In the Industrial Technology business sector, for example, sales have now climbed to nearly 7 billion euros. “The target for sales revenue in 2028 is 10 billion euros – this is important in order to be among the frontrunners in industrial technology,” the Bosch chairman said. He added that the recent acquisition of HydraForce, with its roughly 2,100 associates, will play a central role here: “The takeover of this U.S. specialist has not only tripled our sales of compact hydraulics,” he said. “In addition, HydraForce’s dealer network will also give us better access to the U.S. market.” Bosch Rexroth is also entering a new field – the electrification of mobile machinery. The division has very recently launched its eLion program, a complete product portfolio for this field. It also has a large number of orders from makers of off-highway vehicles. “The electrification of tractors, concrete mixers, and excavators is just what the industry has been waiting for.”

The Consumer Goods business sector also has ambitious growth targets: Bosch Power Tools, for example, aims to more than double its sales by 2030, and to surpass the 10-billion-euro mark. To bring this about, the division already invested some 300 million euros last year in programs such as expanding its accessories business. Further nine-figure investments are planned for this year. One of their focal points will be North America, which on its own represents more than 40 percent of the global power-tool market. BSH Hausgeräte is also strengthening its position there: from 2024, for example, it will manufacture cooling appliances for the North American market in a new factory in Mexico.

Business year 2022: Development by business sector

Mobility Solutions, the company’s biggest business sector, significantly increased its sales by 16.0 percent (12.1 percent after adjusting for exchange-rate effects) to 52.6 billion euros. The margin from operations was better than expected, rising from 0.7 to 3.4 percent. “Despite chronic chip shortages and only weak growth in automotive production, we were able to considerably increase our mobility-related sales,” Forschner said. “And we too were forced to adapt our prices to increased costs.” The Industrial Technology business sector benefited from the robust machinery market. Its sales grew by 13.9 percent (11.0 percent after adjusting for exchange-rate effects) to 6.9 billion euros. Its EBIT margin increased to 9.8 percent. The Consumer Goods business sector suffered from the steep drop in demand for home appliances and power tools. Nonetheless, its sales rose 1.5 percent (1.6 percent after adjusting for exchange-rate effects) to 21.3 billion euros. In addition, the phasing-out of its Russia business put a strain on earnings. Its EBIT margin from operations came to 4.5 percent, following 10.2 percent the previous year. The Energy and Building Technology business sector grew significantly in 2022, by 17.4 percent (15.9 percent after adjusting for exchange-rate effects), to 7.0 billion euros. One of the drivers of this demand was the heavy demand for climate-friendly heating technology. The EBIT margin was 6.0 percent (2021: 5.1 percent).

Business year 2022: Development by region

“In all regions, the Bosch Group was able to post a significant increase in sales in 2022 – above all in the Americas,” Forschner said. Sales in North America rose 25.7 percent to 14.4 billion euros. Adjusted for exchange-rate effects, the figure is 12.3 percent. In South America, sales reached 1.8 billion euros. This is an increase of 26.0 percent, or 16.7 percent after adjusting for exchange-rate effects. Sales revenue in Europe was up 7.3 percent year on year, totaling 44.3 billion euros. Adjusted for exchange-rate effects, growth was 9.8 percent. In Asia Pacific (including other regions), sales rose by 12.8 percent to 27.7 billion euros. Adjusted for exchange-rate effects, growth was 7.1 percent.

Headcount 2022: increase of 18,724 worldwide

As of December 31, 2022, the Bosch Group employed 421,338 people worldwide, and thus 18,724 more than the previous year. Headcount increased in all regions, with most of the growth in the Americas and Asia Pacific. In research and development, headcount grew by 9,422 to 85,543 associates. Of this number, some 44,000 people work in software development.