Emirates Global Aluminium, the world’s largest ‘premium aluminium’ producer and the biggest industrial company in the United Arab Emirates outside oil and gas, today reported its strongest-ever financial results. EGA’s adjusted Earnings Before Interest, Tax, Depreciation and Amortisation (adjusted EBITDA) for 2022 was up 37 per cent to a record AED 12.4 billion ($3.4 billion), compared to AED 9.0 billion ($2.5 billion) in 2021.

Abdulnasser Bin Kalban, Chief Executive Officer of EGA, said: “At EGA, we delivered our best-ever results by focusing throughout the year on what we control – the safety of our people, operational excellence, our costs, and our commercial relationships with our long-term global customers. Our performance demonstrated our resilience and strength at every step of the value chain.

“I am confident that EGA will deliver another competitive performance in 2023 compared to peers in the sector.

“The immediate outlook for aluminium remains under some pressure due to its close correlation to the health of the global economy. More broadly, the prospects for EGA and our sector are very strong due to aluminium’s role in decarbonisation economy-wide. EGA will capitalise on this significant opportunity.”

Financial highlights of 2022

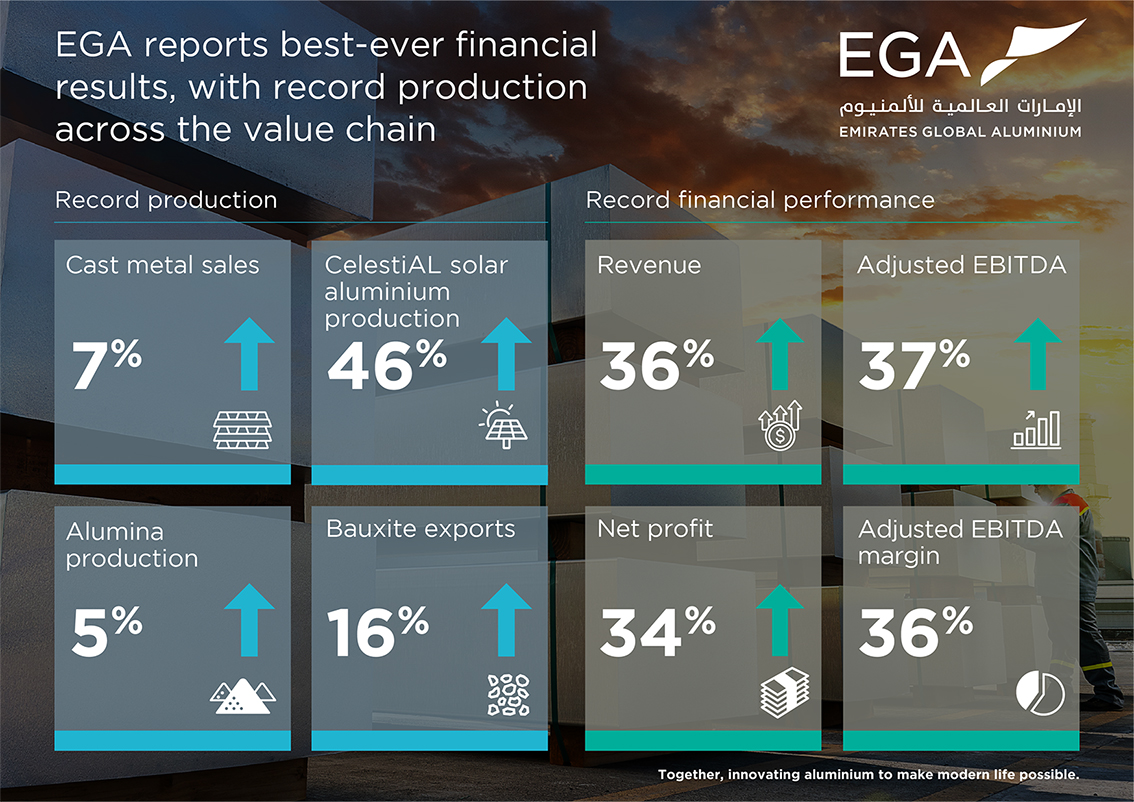

- Record revenue of AED 34.6 billion ($9.4 billion) for 2022, up 36 per cent from AED 25.5 billion ($6.9 billion) in 2021.

- Record adjusted EBITDA of AED 12.4 billion ($3.4 billion), up 37 per cent from AED 9.0 billion ($2.5 billion) in 2021. Average realised LME price of $2,715 per tonne.

- Record net profit of AED 7.4 billion ($2.0 billion), up 34 per cent AED 5.5 billion ($1.5 billion) in 2021.

- Cash generated from operating activities of AED 12.7 billion ($3.4 billion) up 70 per cent from AED 7.5 billion ($2.0 billion) in 2021.

- Adjusted EBITDA margin of 36 per cent, compared to 35 per cent in 2021, one of the highest amongst industry peers.

- Continued deleveraging to strengthen EGA’s balance sheet. EGA’s net debt to adjusted EBITDA was 1.1x at year-end, compared to 2.4x at end 2021.

- Total dividends to EGA’s shareholders of AED 3.7 billion ($1 billion, consisting of an interim dividend of AED 2.2 billion ($600 million) in July and a further dividend of AED 1.5 billion ($400 million) after the end of 2022. This makes dividends related to 2022 the largest in EGA’s history.

- EGA recognised an impairment loss of AED 1.1 billion ($288 million) for mining assets and related equipment at Guinea Alumina Corporation, a prudent accounting measure reflecting the increased cost of capital and other market conditions in Guinea.

Operational highlights of 2022

- Total Recordable Injury Frequency Rate (a measure of all incidents including those not requiring time of work) of 1.42 per million hours worked, continuing a safety performance significantly better than industry benchmarks. There were three Lost Time Injuries in EGA in 2022.

- Record sales of cast metal of 2.72 million tonnes (2021: 2.54 million tonnes). 78 per cent of EGA’s metal sales was value-added products.

- Sales to local UAE customers of 268 thousand tonnes of cast metal (2021: 281 thousand tonnes).

- Production of CelestiAL solar aluminium increased 46 per cent to 57 thousand tonnes (2021: almost 39 thousand tonnes.

- Record production of hot metal of 2.65 million tonnes (2021: 2.50 million tonnes. During 2022, EGA surpassed 40 million tonnes of hot metal produced since start-up in 1979.

- Record production of alumina of 2.43 million tonnes (2021: 2.3 million tonnes). EGA’s Al Taweelah alumina refinery met 47 per cent of EGA’s alumina needs in 2022. Al Taweelah alumina refinery made an AED 919 million ($250 million) contribution to EGA adjusted EBITDA.

- Record exports of bauxite from Guinea of 14 million wet metric tonnes (2021: 12 million wet metric tonnes). Guinea Alumina Corporation made an AED 507 million ($138 million) contribution to EGA’s adjusted EBITDA.

United Arab Emirates, 7 March 2023: Emirates Global Aluminium, the world’s largest ‘premium aluminium’ producer and the biggest industrial company in the United Arab Emirates outside oil and gas, today reported its strongest-ever financial results.

EGA’s adjusted Earnings Before Interest, Tax, Depreciation and Amortisation (adjusted EBITDA) for 2022 was up 37 per cent to a record AED 12.4 billion ($3.4 billion), compared to AED 9.0 billion ($2.5 billion) in 2021.

EGA’s net profit was a record AED 7.4 billion ($ 2.0 billion), up 34 per cent from AED 5.5 billion ($1.5 billion) in 2021.

EGA’s adjusted EBITDA margin was 36 per cent, one of the best amongst global industry peers.

EGA delivered record production at every step of the aluminium value chain from mining to cast metal.

Bauxite exports from the Republic of Guinea were up 16 per cent to 14 million wet metric tonnes. EGA’s bauxite mining subsidiary, Guinea Alumina Corporation, contributed AED 507 million ($138 million) to adjusted EBITDA.

Al Taweelah alumina refinery produced 2.43 million tonnes of alumina, up 5 per cent and meeting 47 per cent of EGA’s total alumina needs, and making an AED 919 million ($250 million) contribution to EGA adjusted EBITDA.

EGA’s hot metal production was a record 2.65 million tonnes. During 2022, EGA passed 40 million tonnes of hot metal produced since the start-up of Jebel Ali in 1979.

EGA cast this hot metal into a record 2.73 million tonnes of finished products. Value-added products, or ‘premium aluminium’ was 78 per cent of sales, with volume increasing slightly from 2021.

EGA’s Najah transformation programme (Najah means ‘success’ in Arabic) began in 2020. Najah is a group-wide programme focused on cost efficiencies and revenue growth. The programme has delivered cumulative EBITDA savings of AED 6.2 billion ($1.7 billion) since its launch. The programme continues to deliver sustainable recurring annual value as well as tools and processes to capture additional opportunities.

EGA’s working capital at the end of 2022 was 30 days, a significant improvement on previous years and one of the best in the industry.

EGA’s average realised London Metal Exchange price for its metal was $2,715 per tonne. The benchmark LME daily price reached a decade-high in March of $3,985 per tonne, before retreating to a low of $2,080 in September.

Abdulnasser Bin Kalban, Chief Executive Officer of EGA, said: “At EGA, we delivered our best-ever results by focusing throughout the year on what we control – the safety of our people, operational excellence, our costs, and our commercial relationships with our long-term global customers. Our performance demonstrated our resilience and strength at every step of the value chain.

“I am confident that EGA will deliver another competitive performance in 2023 compared to peers in the sector.

“The immediate outlook for aluminium remains under some pressure due to its close correlation to the health of the global economy. More broadly, the prospects for EGA and our sector are very strong due to aluminium’s role in decarbonisation economy-wide. EGA will capitalise on this significant opportunity.”

Zouhir Regragui, Chief Financial Officer of EGA said: “These results show EGA’s industry-leading capability both to capitalise on market opportunity and to generate value from mining to metal during more challenging periods. This is testament to the success of our multi-year transformation programme that has so far delivered some $1.7 billion in additional EBITDA over three years.

“In addition, over the past four years, we have improved our working capital and have released close to $1 billion previously trapped in the business.

“Our record financial performance enabled us to further strengthen our balance sheet in preparation for future growth while providing excellent returns for our shareholders. We also took a prudent view with the recognition of the impairment of our asset in Guinea in light of the increasing cost of capital.

“We expect global demand for aluminium to grow by between one and two per cent in 2023, and much more over the decades ahead in the transition to a more sustainable economy. The bulk of new demand will be in secondary and low-carbon primary aluminium, for which there will be a premium. We are growing our business in both these areas.”

At the end of 2022, EGA’s net debt to adjusted EBITDA ratio was 1.1x, compared to 2.4x at the end of 2021 as the company continued to deleverage to strengthen its balance sheet.

EGA paid shareholders a total of AED 3.7 billion ($1 billion), consisting of an interim dividend of AED 2.2 billion ($600 million) in July, and a further dividend of AED 1.5 billion ($400 million) after the end of 2022. This makes dividends related to 2022 the largest in EGA’s history.

EGA recognised an impairment loss of AED 1.1 billion ($288 million) for mining assets and related equipment at GAC, a prudent accounting measure reflecting the increased cost of capital and other market conditions in Guinea.

EGA’s revenue increased 36 per cent to AED 34.6 billion ($9.4 billion). Cash generated from operating activities was up 70 per cent to AED 12.7 billion ($3.4 billion).

During the year, EGA, Abu Dhabi National Energy Company PJSC (TAQA), Dubal Holding and Emirates Water and Electricity Company (EWEC) announced a strategic initiative that would expand clean energy development, progress power assets and generation optimisation, and decarbonise EGA’s aluminium production. Progress was made during 2022 on the continuing detailed negotiations for this initiative, which will then require regulatory approval.

In 2022, EGA produced 57 thousand tonnes of CelestiAL solar aluminium, up from almost 39 thousand tonnes in 2021. BMW Group continued to be the largest customer for CelestiAL. During the year, EGA announced further CelestiAL sales agreements with tier 1 suppliers of Mercedes-Benz and Nissan.

EGA’s supply of metal to local UAE customers was 268 thousand tonnes during 2022, compared to 281 thousand tonnes in 2021, due to various customer-specific factors. EGA is a champion of Make it in the Emirates, and the company’s metal supply has led to the development of a significant downstream industry in the UAE which supplies local and global customers.

The company’s Total Recordable Injury Frequency Rate, a broad measure of all incidents including those that do not require time off work, was 1.42 per million hours worked. EGA’s safety performance was significantly better than industry benchmarks. There were three Lost Time Injuries in 2022, the most serious of which was leg injury. The employee fully-recovered and returned to work.