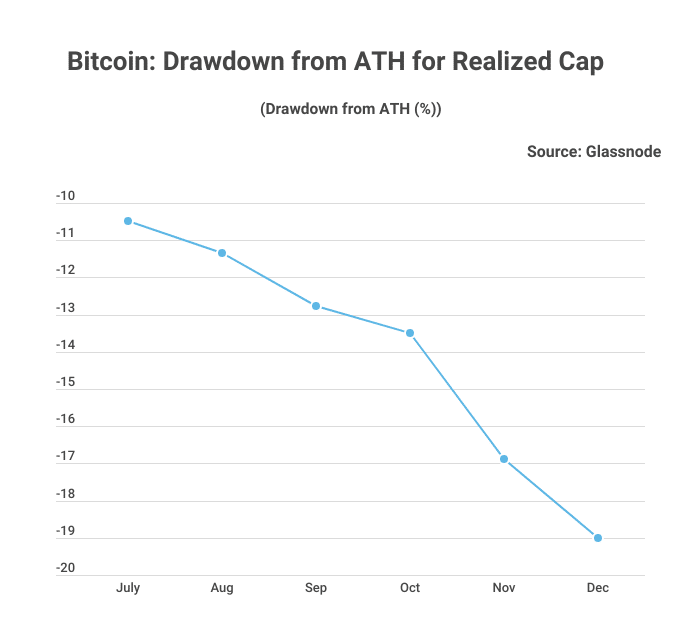

Bitcoin prices have remained bearish since the beginning of this year. According to BitcoinCasinos.com, the Realized capitalization drawdown measured at -19%, marking the second-largest drawdown in its history. This was only eclipsed by the pico-bottom of the 2011 bear market.

At this stage of the crypto winter, Bitcoin’s on-chain indicators have registered extremely low values that suggest a possible bottom for this bear market. While some metrics are giving out positive signals, others, such as the realized cap, ominously point to a final capitulation yet to come.

BitcoinCasinos Betting expert Edith Reads commented on the data saying,” It is difficult to accurately predict when the market will turn, but one thing remains certain – Bitcoin is still the most dominant cryptocurrency in the world and its future is bright. Those who remain patient and hold onto their BTC have the potential to reap huge returns when this bear market ends.”

Crypto Winter

Bitcoin’s bear market has been part of a much wider Crypto Winter that has seen the entire crypto market take a hit. The Fed’s decision to hike interest rates and reduce asset prices on the risk spectrum had an immediate knock-on effect, leading to an economic slowdown and a lack of demand in the market.

The Crypto Winter has been further exacerbated by retail investors moving out of their positions and institutional investors taking profits during this bear market. This means that Bitcoin and other cryptocurrencies have lost significant value since the end of 2021, with most coins seeing losses greater than 50%.

Price Charts Are Still Tilting Bearish

The Bitcoin bear market has been an arduous test for cryptocurrency investors and traders, who have seen their portfolio values drop significantly over the past year. With no clear indication that the bear market has ended, investors are advised to exercise caution and not get caught up in the FOMO of a possible bottom. The only way to identify when the bull run will start is to closely monitor on-chain metrics for any further signs of capitulation or recovery.

Bitcoin’s recent move past $17,000 shows that it is full of surprises, and investors can still expect good returns with some patience. It is still too early to determine if the current bear market has already reached its bottom. Whichever scenario ultimately happens, the crypto market is currently in a state of limbo, and investors will have to be patient while they wait for its macroplane to emerge this year. Until then, BTC’s bears will continue to play an influential role in the market.