Following a series of economic downturns, the European electric vehicle (EV) market is showing resilience despite the prevailing macroeconomic factors that have impacted consumer spending.

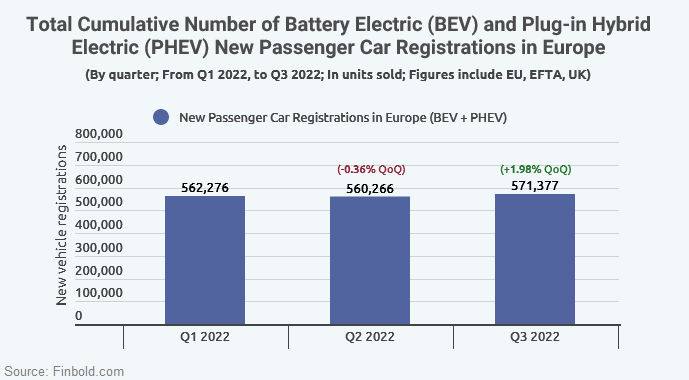

In particular, data acquired and calculated by Finbold on November 29 indicates that as of Q3 2022, the total number of Battery Electric (BEV) and Plug-in Hybrid Electric (PHEV) new passenger vehicles registrations in Europe stood at 571,377. The value represents a quarterly increase of about 1.98% from Q2’s value of 560,266. During Q1, the region recorded a registration of 562,276 units.

A breakdown of the car types indicates that BEVs stood at 355,336 in Q3, slightly increasing from Q2’s figure of 322,144, while in the first quarter, the registration was 325,285. Elsewhere, during the third quarter of 2022, the total registered PHEVs was 216,041, a drop from Q2’s 238,122. During Q1, the region had 236,991 new PHEV units.

Notably, the total number of new passenger car registrations across Europe with an alternative fuel type recorded a quarterly drop of 2.47% to 1,265,947 in Q3. In Q2, the cars stood at 1,297,966, representing a drop of 2.88% from Q1’s 1,336,523.

Drivers of Europe’s EV market growth

The research acknowledged that the European EV market had grown significantly while highlighting some key drivers. According to the research report:

“In general, the European EV market’s previous growth has been attributed to factors like increased income levels within a climate-conscious population, robust government support for the EV industry, and an extensive public-private partnership for EV charging infrastructure.”

Despite the growth, the EV space still faces several hurdles, with the cost factor emerging as a critical obstacle. At the same time, how the prevailing economic conditions will impact the sector is yet to be seen.

Read the full story with statistics here: https://finbold.com/europes-electric-vehicle-2022-sales-grow-in-q3-despite-economic-challenges/

European EV market battles economic slowdown

Despite the progress made in the European EV market, the economic slowdown was expected to tame the mighty industry temporarily. Indeed, EV sales have emerged despite consumers and manufacturers being impacted by the ongoing turmoil characterized by high inflation and a possible recession.

At the same time, economic volatility has seen increasing cases of unemployment, and it can be assumed that the conditions would push consumers to cut spending on new technology like EVs and delay investments in non-essential products awaiting the conditions to stabilize. In such conditions, consumers are likely to go for more economical choices.

Therefore, the growth in Q3 highlights the sector’s resilience considering before the current economic crisis, the industry had battled pandemic-related issues. In this case, with the pandemic disrupting the supply chain, a global semiconductor shortage hit the electric vehicle space hard. Interestingly, some manufacturers like Tesla (NASDAQ: TSLA) delivered a record number of vehicles in Q3 despite the prevailing conditions.

Key drivers of European EV market growth

In general, the European EV market’s previous growth has been attributed to factors like increased income levels within a climate-conscious population, robust government support for the EV industry, and an extensive public-private partnership for EV charging infrastructure.

At the same time, due to the lucrative European market, manufacturers, especially from the United States and China, are increasingly targeting consumers in the region. Indeed, Chinese carmakers are building a foothold on the market, especially for BEVs. European carmakers will likely attempt to wane off the competition from foreign entities by increasing their EV production.

Potentially, new EV manufacturers interested in establishing a foothold in the industry will likely locate their operations in Europe. For instance, Rivian (NASDAQ: RIVN), which is anticipated to increase production in 2023 to meet the growing demand, is one example.

The firm will likely begin sales in Europe at some point in the not-too-distant future. For the time being, however, the company is concentrating primarily on the North American market in an effort to challenge Tesla’s position as the industry leader.

Furthermore, the sales data is a welcomed development for regional regulators as the European Commission seeks to achieve a climate-neutral economy by 2050. In this case, regulators have put restrictions on automotive emissions, with most governments expressing commitment toward climate-friendly mobility initiatives. Consequently, several countries are driving EV adoptions by establishing friendly incentives targeting consumers and manufacturers.

Additionally, consumers are increasingly getting a wide range of options, especially with traditional manufacturers, including BMW, Audi, and Volvo, venturing into the electric vehicle industry. With an array of options, manufacturers have been focusing on improving some of the concerns among concerns.

For instance, driving range has been a significant consideration among consumers, with automakers aiming for longer ranges to boost sales, especially for BEVs. In this case, manufacturers focused more on increasing driving range through adjustments like larger batteries. Furthermore, the availability of charging stations around the driving range appears to have been taken care of.

The future of the European EV market

However, despite the impressive EV sales for the third quarter, it is worth noting that the sector is yet to become a phenomenon across Europe amid several challenges. For instance, consumers still need to overcome the hurdle of high EV costs and a need for sufficient charging infrastructure.

Over the years, the affordability of electric vehicles has been a critical concern forcing budget-conscious buyers to stay on the sidelines with premium pricing.

Furthermore, EV sales across Europe will likely accelerate, fueled by the possible extended energy crisis. Notably, following Russia’s invasion of Ukraine, the region is grappling with high energy prices, a factor acting as a catalyst to transitioning from reliance on fossil fuels. Overall, how the sector will hold up against the extraordinary conditions remains to be seen.